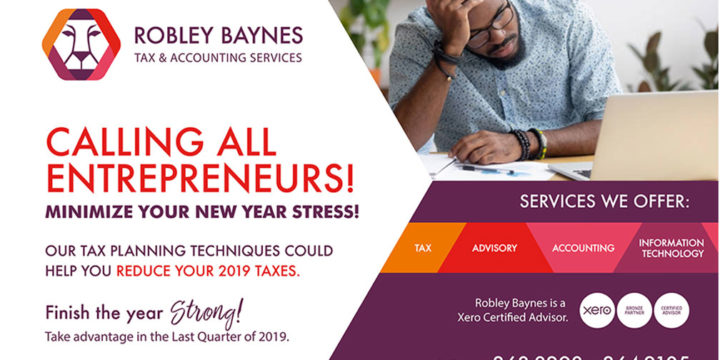

Tax Planning For Business Profitability

In today's competitive business environment, tax planning goes beyond mere compliance; it becomes a strategic tool for enhancing profitability and ensuring sustainable growth. Effective tax planning is a vital component of financial management for business owners, influencing key decisions and shaping the path to growth and success. The Impact of Tax Planning on Business Decisions Tax planning is an essential component of maximizing business profitability. By strategically managing your business's tax obligations, you can effectively reduce tax liabilities and increase your bottom line. Here are some tax planning strategies that can help improve business profitability Maximizing Profitability By strategically managing your tax obligations, you can reduce your tax liabilities and increase your bottom line. This additional cash flow can be reinvested in your business to drive growth…